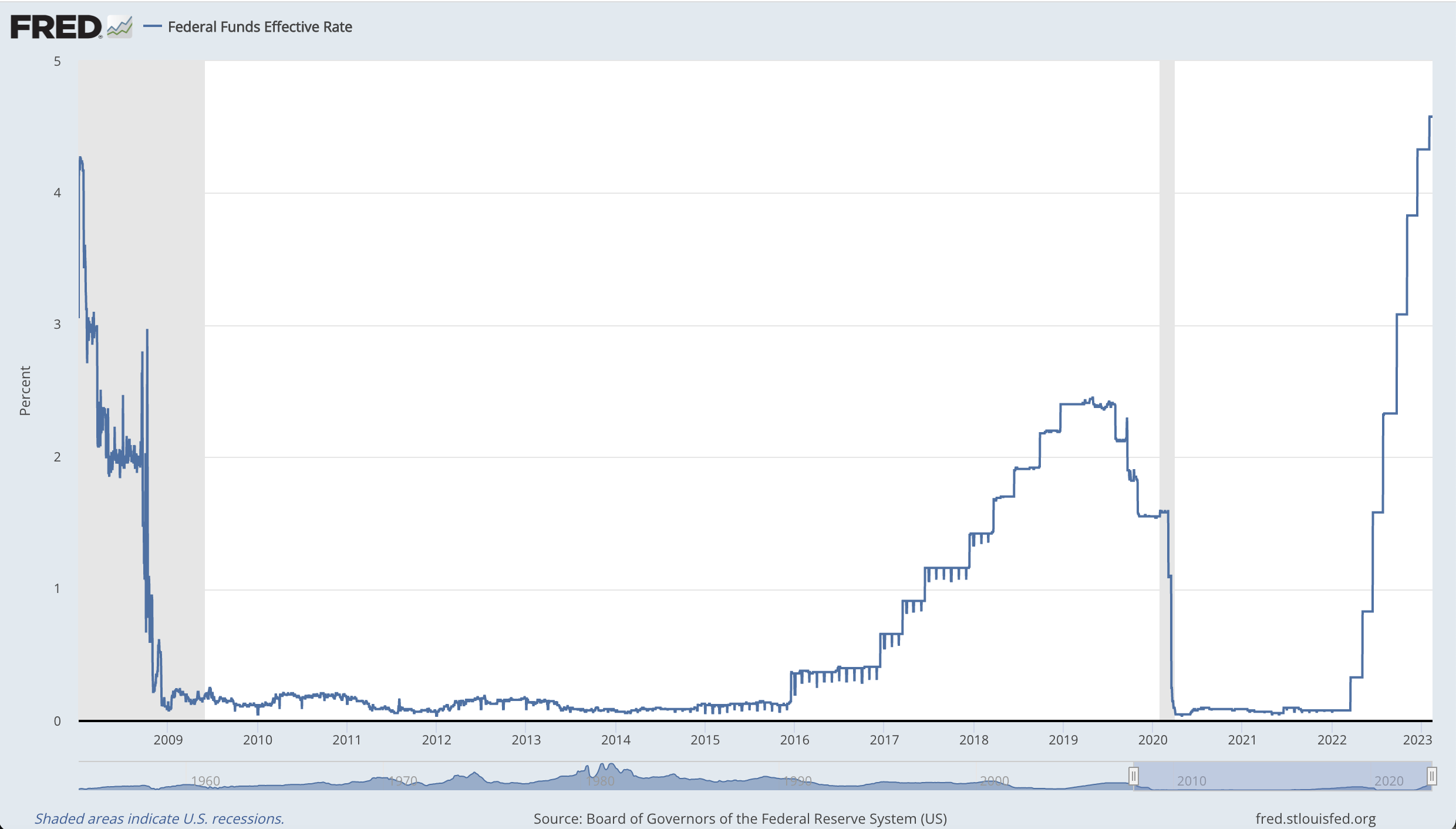

As we all know, prices are rising. With the Fed relentlessly hiking interest rates, the general economy has been struggling despite few areas. This matters because the Fed funds rate is “the interest rate depository institutions charge each other for overnight loans of funds” (FRED).

FRED Data: Effective Federal Funds Rate since January 1st, 2008.

To put this into context, this means higher borrowing rates for banks and therefore consumers (the highest since 2008). How does this affect startups exactly? Well, this can be directly and indirectly explained. If money is tight right now, investors are a lot less likely to put their money towards a hopeful startup endeavor that carries the risk that it may not outperform or even meet its expectations any time soon, if ever. One of the main factors startup funders will take into consideration is consumer spending. With food prices and rent historically high, especially when compared to static wages not pacing par with the consumer price index, people have less discretionary income (not to be confused with disposable income, this is income left after all mandatory expenses such as rent and other unavoidable costs)—if any at all—to put towards nonessential products.

Considering the decrease in discretionary income, there aren’t a whole lot of investors who will offer funding to get a startup into the market if there is essentially no market of buyers to send it out to. The technical term for this funding is called ‘venture capital’ sometimes abbreviated to ‘VC’ (further explained in our previous blog “What is … venture capital?”). With historically high inflation rates, and historically high federal funds rates to combat that inflation, we’re moving into an economy that just doesn’t have room for venture capital in the near future. We’re here to discuss how startups can deal with this hit and stay in the competition rather than disappear into the oblivion of failed startups.

First thing’s first, cut costs, but in the right areas. The first connotation someone may have with the word recession could be “layoffs,” but for startups this is not the most attractive cost cutter. This is due to the atrocious cost that employee turnover has. Investopedia notates: “It can take up to six months or more for a company to break even on its investment in a new hire.” With the already limited and finite funds that startups have, this cost could be debilitating, if not completely detrimental, to its livelihood or chance of survival in already tough times. The best thing a startup can do in tough financial times is retain their employees. It doesn’t just take time and money to train the replacement, but there is no guarantee that those efforts won’t be futile if that person decides the job isn’t the right fit for them or vice versa. In that case, not only did that startup lose a knowledgeable and loyal employee, but it’s a gamble that they may ever find the same quality in the next person. Not to mention, there may be no wage savings with the replacement as contracts for new employees will reflect competitive market wages to attract that replacement in the first place, which may be at par or even more than what the startup was paying the previous employee for the same job who may have already been much more effective at the job with their experience and expertise with that company under their belt.

Instead of beating a dead horse in terms of cutting costs, let’s approach the opposing end of this conversation: is funding during a recession even possible for startups? Earlier, I mentioned that there isn’t much room for venture capital in investor portfolios during a recession, I didn’t say there was no room! The next most important asset for a startup during a recession is to remain optimistic and seek funding from other avenues. Sudeep Srivastava from AppInventiv points out an option that isn’t ideal, but an option that may be the saving grace for startups depending on their goals and/or desperation. In times of low funds and tight money, but a prospective eventual future, startups can offer more equity in their company to investors in order to gain the investors who may have otherwise placed those funds in something more sensible to them or perhaps less risky than a startup. What‘s considered to be a basic economic truth is that with more risk, there is more return, and the same goes for a higher stake in a startup that may or may not ever reach realization (always true, but only emphasized during a recession). For investors more reserved with their money, startups would have to offer those investors a better deal to convince them to buy into something so risky during tumultuous financial times. With this, offering equity, perhaps even disproportionately—considering what a startup may eventually become—may be an essential, seemingly irrational tactic; it doesn’t seem to make much economic sense, but if it could be the only determining factor between a startup dying out, or passing the resistance point for long term survival, then it’s a tactic worth considering. As the saying goes: beggars can’t be choosers.

With the unpredictable economic year we endured last year, there’s no telling which way market sentiment will move this year, but a positive definitive upturn at this time seems unlikely. Even in worst case scenario, there is still hope for startups in the meantime while the market restabilizes. Startups need to be tactical and conservative with funds that they already have as more are not promised (perhaps not any time soon), they need to understand the value of current team members, and they need to buckle up for the ride because it looks to be a bumpy road ahead.