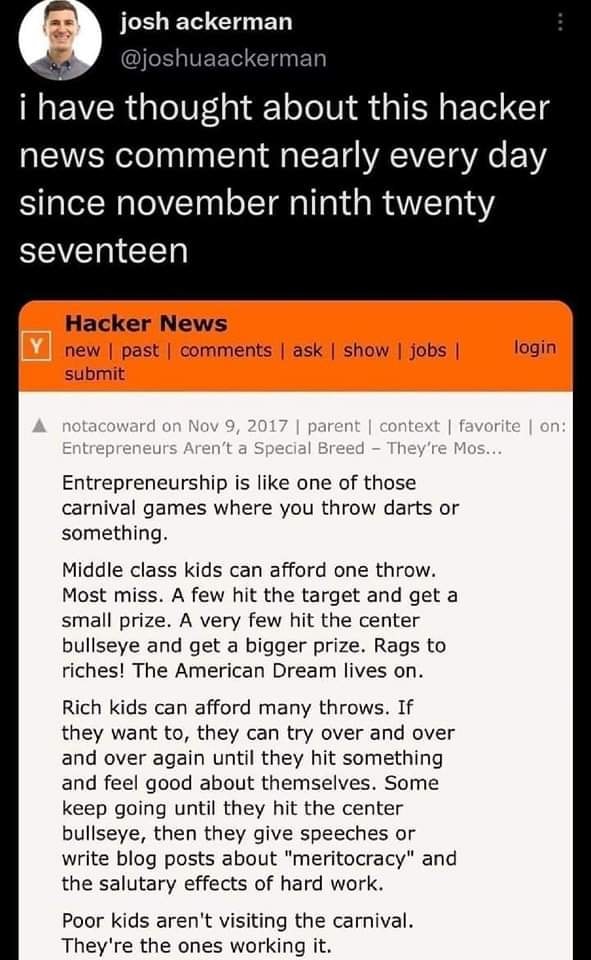

The journey of turning a groundbreaking idea into a successful startup is exhilarating, yet it often presents a formidable challenge: securing funding. For years, the conventional path to funding has followed a set series of stages, from pre-seed to IPO. However, this traditional model tends to favor some entrepreneurs while creating barriers for aspiring entrepreneurs who lack the connections necessary to access the conventional path.

A screenshot of an Instagram that references a 2017 Hacker News comment about entrepreneurship and generational wealth epitomizes how many feel about access to startup funding for Americans.

In this series, we embark on a transformative exploration of startup funding, aiming to subvert the established narrative. We will follow the inspiring story of Maya, a Black woman tech entrepreneur from Omaha, Nebraska, as she navigates the intricacies of funding her startup. Maya’s journey will illuminate the inherent inequalities within the system, while also highlighting alternative approaches and resources that empower entrepreneurs outside the traditional mold.

Our series will examine each of the six stages of startup funding, and will discuss both the traditional way startups navigate the stage as well as the way entrepreneurs might subvert the system.

- Pre-seed Funding Stage:

Maya begins her entrepreneurial journey by seeking pre-seed funding to transform her idea into a viable business model. Faced with barriers that disproportionately affect underrepresented entrepreneurs, she discovers support from various Omaha nonprofits, government agencies, and businesses that champion diversity and inclusion. For instance:

- The Omaha Small Business Network provides mentorship and guidance, helping Maya refine her business plan and connect with potential investors.

- Nonprofit organizations like Empowerment Omaha offer grants and resources specifically designed to uplift underrepresented entrepreneurs, allowing Maya to access crucial startup capital.

- Local government agencies, such as the Omaha Economic Development Corporation, offer grants and incentives to foster innovation and entrepreneurship within marginalized communities.

- Seed Funding Stage:

As Maya’s startup gains traction, she enters the seed funding stage, requiring significant capital to fuel growth. She harnesses alternative funding sources in addition to traditional avenues. Maya taps into Omaha’s vibrant startup ecosystem and leverages partnerships with local businesses and organizations that share her vision. Examples include:

- Collaborations with established corporations like Mutual of Omaha, who have programs supporting startups and diverse founders, provide funding and valuable industry connections.

- Participation in pitch competitions hosted by organizations like the Greater Omaha Chamber of Commerce, where Maya can showcase her innovative ideas and secure funding from potential investors.

- Networking events organized by groups such as Women’s Center for Advancement and the Omaha Minority Business Development Agency, allowing Maya to connect with angel investors and venture capitalists who prioritize supporting underrepresented founders.

- Series A Funding:

Entering the Series A funding stage, Maya faces new challenges but discovers alternative paths to success. She actively seeks out angel investors and venture capital firms that prioritize diversity and inclusion. Maya also utilizes programs offered by local institutions, such as:

- The University of Nebraska Omaha’s Center for Innovation, Entrepreneurship, and Franchising, which provides funding, mentorship, and access to a network of experienced entrepreneurs and investors.

- Partnerships with corporate innovation hubs, like the Union Pacific Railroad’s Center for Entrepreneurship, which offer funding and expertise to startups driving technological advancements.

- Series B Funding:

Maya’s resourcefulness leads her to creative funding solutions during the Series B stage. She explores partnerships with Omaha-based businesses, securing strategic investments that align with her startup’s mission. Examples include:

- Collaboration with the AIM Institute, a nonprofit organization that supports technology education and workforce development. Through AIM’s investor network, Maya connects with local angel investors who are passionate about supporting innovative startups.

- Engaging with Omaha’s thriving fintech sector, partnering with financial institutions like First National Bank, which provide access to capital and expertise in the financial technology space.

- Series C Funding, Series D Funding and Beyond::

As Maya’s startup continues to grow, she enters the Series C funding stage, requiring substantial capital to expand operations and scale her business. She pursues a combination of traditional funding avenues and alternative resources. Examples include:

- Engaging with venture capital firms that focus on funding women-led and minority-owned startups, such as Revolution’s Rise of the Rest Seed Fund, which supports entrepreneurs outside traditional tech hubs.

- Exploring strategic partnerships with large corporations that provide both funding and access to new markets, such as Berkshire Hathaway, a conglomerate with diverse business interests based in Omaha.

Maya’s resilience shines as she reaches the Series D funding stage and beyond. She continues to diversify her funding sources, exploring avenues such as corporate partnerships, strategic investments from institutional investors, and global investment opportunities. Examples include:

- Partnering with corporate innovation arms like TD Ameritrade’s thinkorswim® Innovation and Investing Lab, which invests in promising startups while providing access to a network of experienced professionals and resources.

- Exploring opportunities for international expansion and securing investments from global venture capital firms that specialize in supporting diverse founders.

In her pursuit of startup funding, Maya encounters the realm of mezzanine funding and bridge loans. She creatively utilizes these financial instruments to bridge the gap between funding rounds, ensuring the continuity of her venture’s progress. Maya taps into resources such as local credit unions, community development financial institutions (CDFIs), and online lending platforms to access these alternative funding options.

6. IPO:

The final stage of Maya’s journey leads her to the pinnacle of success—an Initial Public Offering (IPO). She challenges the notion that this path is exclusive to a privileged few by exploring avenues such as equity crowdfunding, where individuals from the community can invest and become shareholders in her startup. Maya leverages online platforms and communities to amplify her IPO campaign, enabling wider participation and democratizing access to investment opportunities.

Maya’s journey through Omaha’s diverse ecosystem of nonprofits, government agencies, and businesses exemplifies the power of alternative resources in subverting the traditional startup funding narrative. By leveraging partnerships, grants, mentorship, and the support of communities, she overcomes barriers faced by entrepreneurs without access to generational wealth. Maya’s inspiring story demonstrates that with resourcefulness, resilience, and a supportive network, entrepreneurs can forge their own paths to success and contribute to a more inclusive and diverse startup ecosystem. Stay tuned for our first installment, where we delve into Maya’s remarkable journey through the pre-seed funding stage.

**AI contributed to this article**