Midwest investment opportunities are overlooked. While venture capital has historically pooled along the coasts, recent years have revealed a quiet transformation in the center of the country. Today, the Nebraska startup ecosystem offers strong ties to industries often overlooked by coastal markets, with clear traction, low burn rates, and strong ties to industries often overlooked by coastal markets.

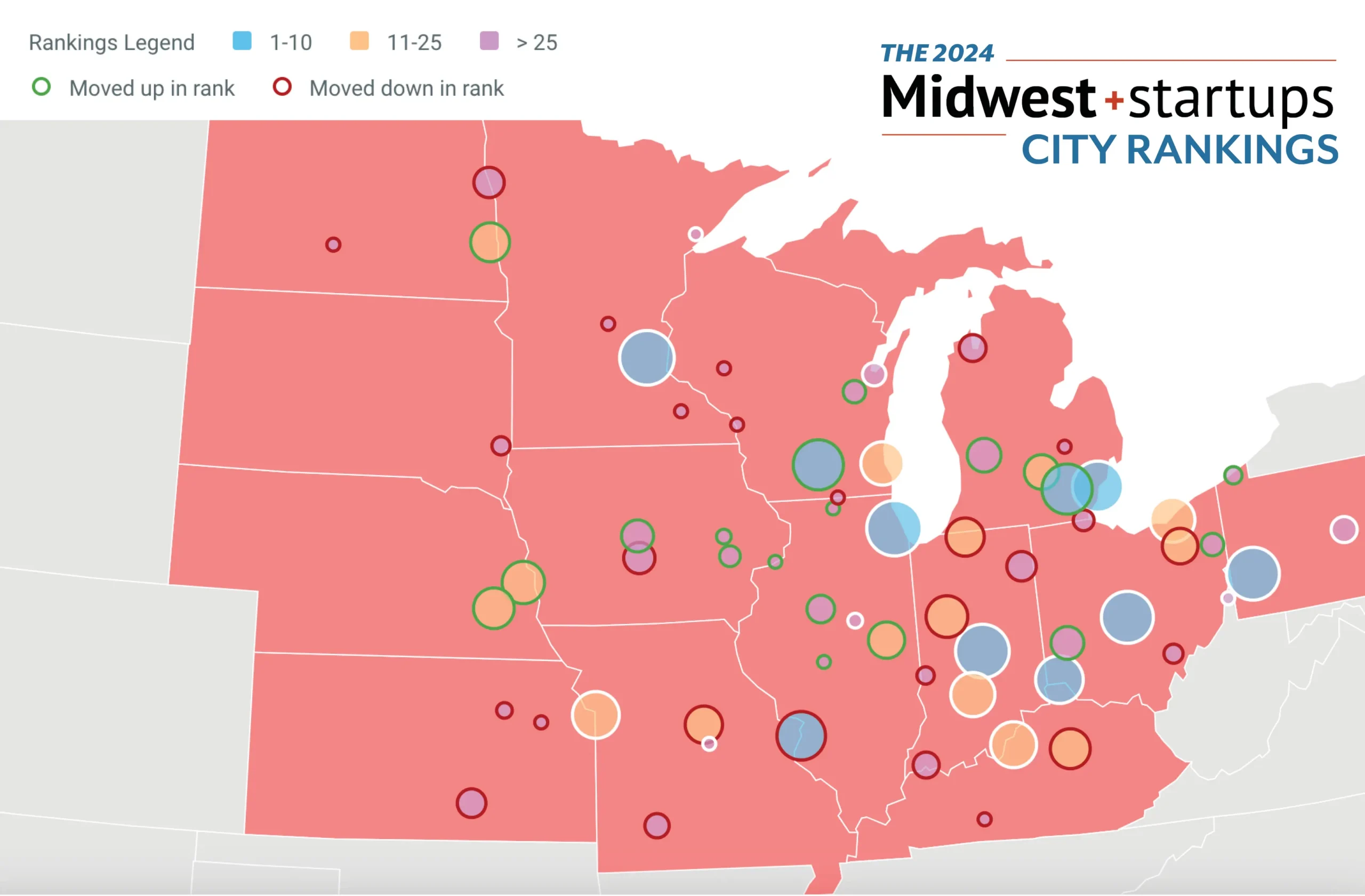

Map of midwest, compiled by Midweststartups.com ranking the startup activity in cities across the region. Click on the image to view the full rankings and data.

The Case for the Middle

The Midwest is not a monolith, but it does share some compelling common traits that make it attractive to investors seeking value and durability:

- Lower startup costs: Founders can do more with less, reducing dilution and increasing capital efficiency.

- Longer talent retention: Developers, researchers, and ops professionals are more likely to stay with startups, lowering churn and preserving institutional knowledge.

- Market proximity: Many startups are embedded in industries like agriculture, logistics, healthcare, and manufacturing—core economic sectors where the Midwest excels.

- Remote-native operations: Post-pandemic, startups are building from day one with distributed teams and lean structures.

These characteristics make companies that expand at a more measured pace, with healthier fundamentals and less volatility. For investors, that means valuations grounded in real performance and a higher likelihood of follow-through beyond a flashy seed round.

A Growing Network of Ecosystems

Across cities like Chicago, Minneapolis, Indianapolis, and Columbus, support systems are rapidly evolving. The top five cities by rank are: Chicago, Minneapolis, Indianapolis, Pittsburgh, Columbus, with accelerators, venture studios, and public-private coalitions backing founders with substantial capital commitments. Funds throughout the Midwest: Ann Arbor’s Arboretum $268M, Milwaukee’s Baird $218M, Detroit’s Assembly $76M, Green Bay’s TitletownTech $70M, Madison’s NVNG $50M FoF, and Grand Rapids’ Grand $50M.

The new landscape is being quietly built by community-oriented leaders with a long-term view—not just chasing unicorns but cultivating resilient business infrastructure that serves traditional industries. According to the Midwest Startups blog, “these companies sell to the industries that form the backbone of the U.S. economy—horizontal software for mid-market and Fortune 500 companies, healthcare IT for major pharmaceutical companies, payers and providers, manufacturing and industrial SaaS in support of one of the Midwest’s foundational sectors and everything else in between.”

Midwest investment opportunities are particularly compelling due to Midwest startups’ reputation for capital efficiency, even during periods of growth. Midwest startups require less capital infusion due to a lower cost of living, among other factors, and tend to produce better outcomes for investors compared to other geographic areas.

Omaha hosted the first Nebraska Data & AI summit on August 19, 2025 for entrepreneurs, startups, state and federal officals to explore the AI landscape and the potenital benefits and challenges for Nebraskans.

Photo via govtech.com

Spotlight: Omaha’s Rise in AI and Health Innovation

Within this regional shift, Omaha is carving out a notable niche. Part of the Nebraska startup ecosystem, the city has recently doubled down on AI-enabled healthcare, research commercialization, and early-stage innovation. A growing number of founders are translating university research into products with real clinical value.

What sets Omaha apart isn’t just its sector focus—it’s the collaborative culture that powers it. Here, partnerships between medical researchers, community colleges, and entrepreneurs aren’t just marketing copy. They’re how things get built. Infrastructure keeps growing, and midwestern investors are beginning to form syndicates that give coastal firms clear on-ramps into regional deals.

For coastal investors seeking untapped markets with clear differentiators, Omaha offers:

- Proximity to both research and healthcare deployment.

- Access to motivated, under-the-radar founders.

- Strong AI and medical device potential in early-stage companies.

While the city may not yet be a household name, it reflects the values and mechanics increasingly common across the Midwest—scrappy, capable, and ready to grow.

Final Take

The time is right to look beyond the coasts. The Nebraska startup ecosystem, along with its regional neighbors, offers compelling entry points into high-potential ventures built on real-world insight and long-term fundamentals. Midwest investment opportunities aren’t the future—they’re already here. Investors just need to take a closer look.

If you’d like to stay connected with us, be sure to sign up for our newsletter or follow us on LinkedIn and Instagram for updates, insights, and new opportunities. If you’re a student, entrepreneur, or investor interested in working with us, you can connect directly with a member of our team—we’d love to hear from you.